China continues to lead in energy transition with low carbon power

China total power generation mix, 2015-40

LONDON and HOUSTON and SINGAPORE, Dec. 12, 2024 (GLOBE NEWSWIRE) — As the energy landscape rapidly transforms due to decarbonization, electrification, and geopolitical shifts, Wood Mackenzie has released five compelling charts that highlight key trends shaping the sector in the latest Horizons report.

These charts in the report titled ‘Conversation Starters: Five Energy Charts to Get You Talking’ provide valuable insights into the dynamics of energy markets, encompassing everything from the power systems of major economies to the growing adoption of electric vehicles.

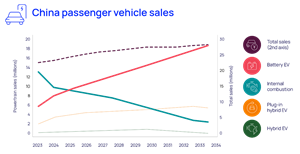

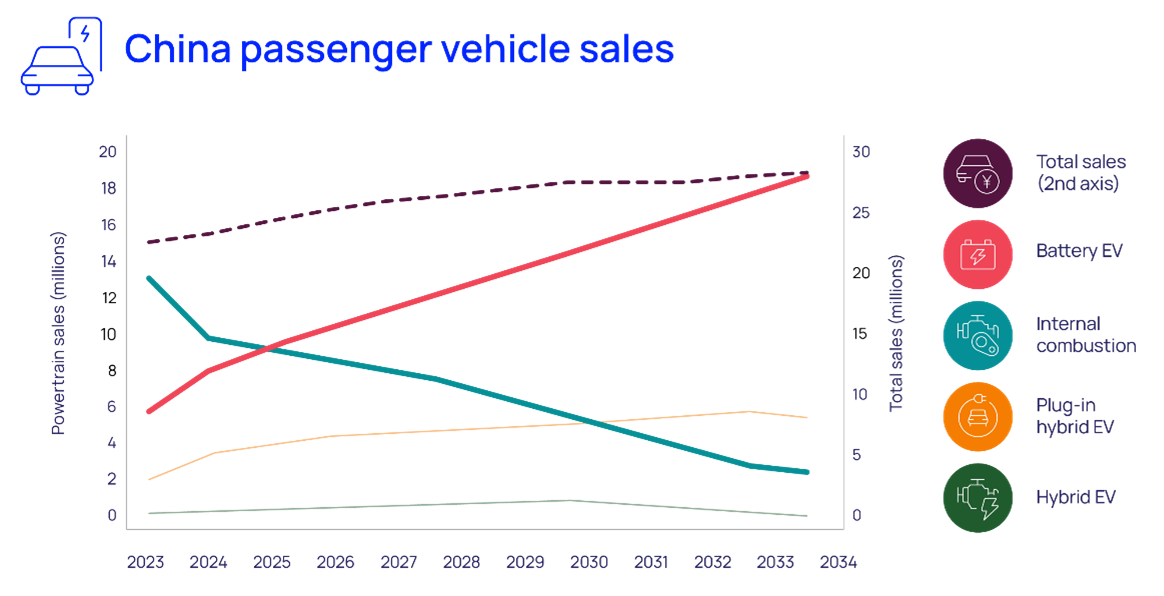

China passenger vehicle sales

“Between the power markets of the U.S. and China, the curious case of the North Sea transition, the towering ambition of CCS and the electrifying rise of EVs, these charts track the wonders of the energy transition in 2025 and beyond,” said author Malcolm Forbes-Cable, Vice President, Upstream and Carbon Management Consulting at Wood Mackenzie.

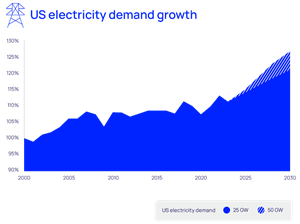

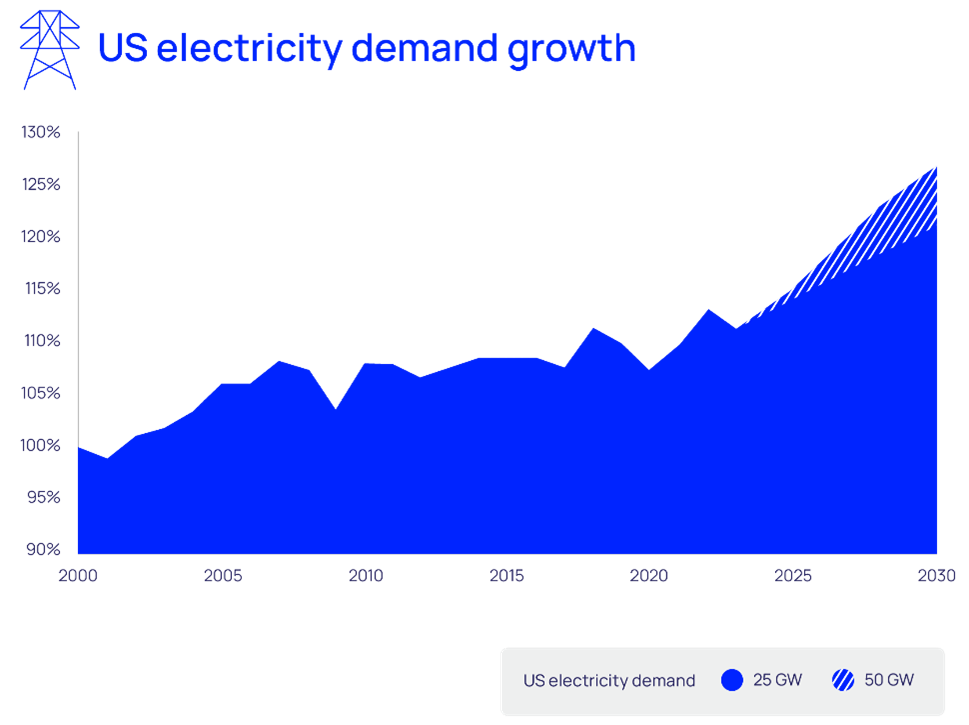

US electricity demand growth

In the Horizons report ‘Top of the Charts: Five Energy Charts to Make You Think’, each chart was evaluated based on its ‘Wow Factor,’ conversational appeal, industry signpost and dissonance, offers a new lens on the energy transition.

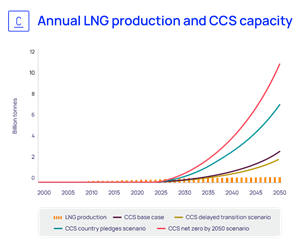

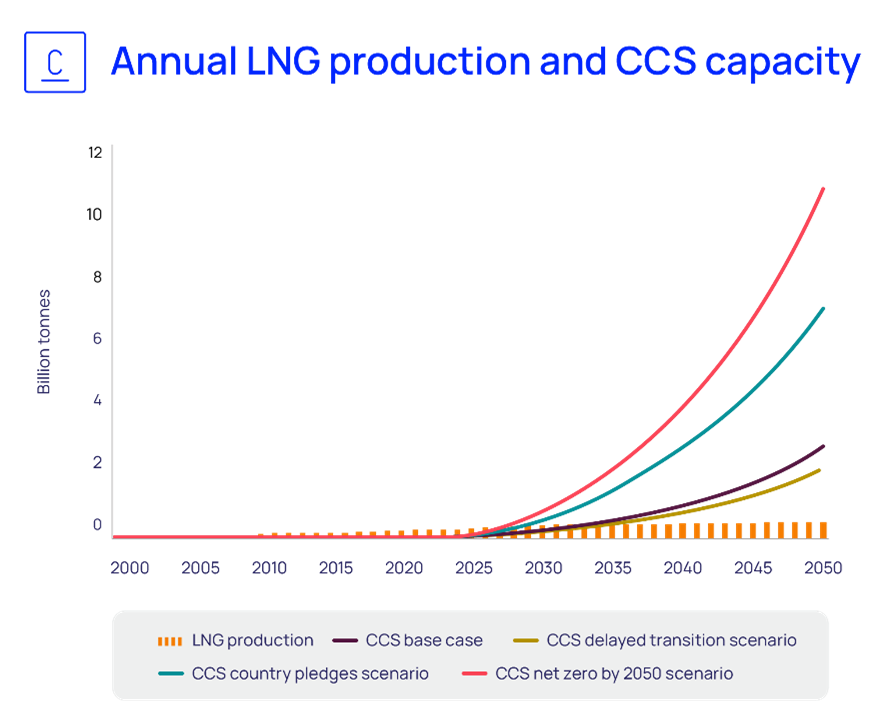

Annual LNG production and CCS capacity

Chinese transport: truly electrifying

China continues to lead the energy transition, in a pathway to source 50% of its power from low-carbon energy including hydro, solar, wind, nuclear, and energy storage by 2028, according to Wood Mackenzie. The report also projects that solar and wind capacity will exceed coal-fired power generation by 2037.

“Never has the world witnessed the pace of growth or transformation of an energy system that China is currently achieving,” said Forbes-Cable. “By 2025, China’s installed solar and wind capacity will exceed that of both Europe and North America.”

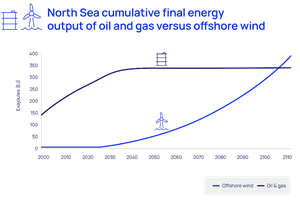

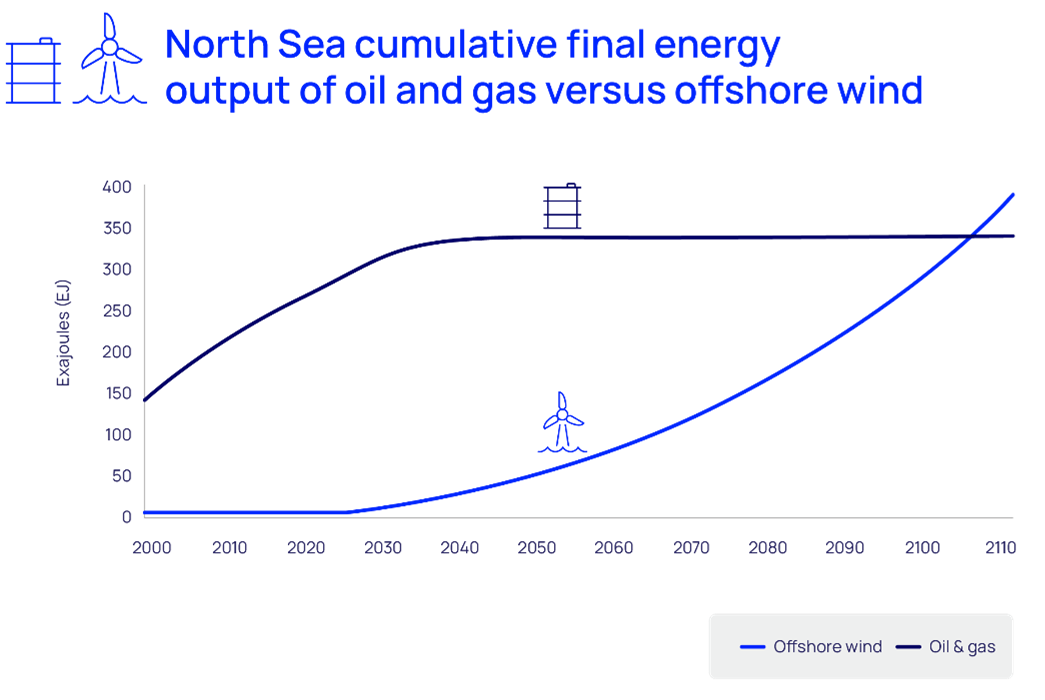

North Sea cumulative final energy output of oil and gas versus offshore wind

Source: Wood Mackenzie Lens

China’s transport sector is also undergoing a significant transformation. By 2034, battery electric vehicles (BEVs) will dominate passenger vehicle sales, reaching a 66% market share. Combining BEVs and hybrids, EVs will constitute 89% of total sales, according to Wood Mackenzie.

“BEVs are projected to grow by 8% annually through 2030, while sales of internal combustion engine (ICE) vehicles are expected to decline by 11% each year,” said Forbes-Cable. “Wherever you are, Chinese EVs are coming your way.”

Source: Wood Mackenzie

U.S. power: data’s growing power habit

Meanwhile in the United States, power demand is also set to grow steadily after years of stagnation, largely due to the Fourth Industrial Revolution and increasing electrification. Key areas driving this demand include data centres, clean technology manufacturing, and the production of renewable energy equipment.

“Power demand is expected to grow by up to 1.9% compound annual growth rate (CAGR) through 2034, highlighting the necessity of accelerating grid modernisation to maintain the U.S.’s competitive edge amid rising global competition, particularly from China,” said Forbes-Cable.

Source: Wood Mackenzie, Energy Information Administration

Carbon capture and storage: the ambitions of youth

Juxtaposing the Carbon capture and storage (CCS) capacity with LNG production creates an interesting illustration of the scale of the ambition for CCS. This chart is not drawing equivalence between the two industries but compares the growth of two large industrial systems handling gas in a cooled liquid state.

“Even in the delayed energy transition scenario, CCS capacity is expected to be three times greater than LNG supply volumes by 2050, while in the base case, it will be four times greater. This will require impressive growth rates!” said Forbes-Cable.

Source: Wood Mackenzie Lens

North Sea energy: the tortoise and the hare

The North Sea, once a significant source of oil and gas, was at the vanguard of the offshore wind sector. This chart plots oil and gas against offshore wind by quantifying the cumulative final energy output. Currently, the offshore wind capacity stands at 36 gigawatts (GW) and is projected to exceed 240 GW by 2050. Even so it will be past the end of the century before offshore winds cumulative energy output surpasses oil and gas.

Forbes-Cable said, “Having spent a number of years on rigs in the North Sea and experienced the awesome nature of the weather I was always curious as to the energy output from above and below the sea.”

North Sea cumulative final energy output of oil and gas versus offshore wind

Source: Wood Mackenzie Lens

Note: Beyond 2050, for the purposes of finding the intersection, it has been assumed that offshore wind power output grows by 2% annually.

For further information please contact:

Mark Thomton

+1 630 881 6885

Hla Myat Mon

+65 8533 8860

hla.myatmon@woodmac.com

The Big Partnership (UK PR agency)

woodmac@bigpartnership.co.uk

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That’s why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years’ experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers’ decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with ‘unsubscribe’ in the subject header.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/94f72cae-60bf-4b7a-adf6-b9e748397ab0

https://www.globenewswire.com/NewsRoom/AttachmentNg/8c853cd8-46fb-42ae-8ef0-533b3baa8652

https://www.globenewswire.com/NewsRoom/AttachmentNg/a86b26bb-9f36-44c3-acf9-2438ea04d5a0

https://www.globenewswire.com/NewsRoom/AttachmentNg/22e0414c-cdf3-4518-b5e2-165ea49f7bd6

https://www.globenewswire.com/NewsRoom/AttachmentNg/3c0d1bca-59af-4b12-b78b-3a169e163ea4

GlobeNewswire Distribution ID 1001028410